Introduction

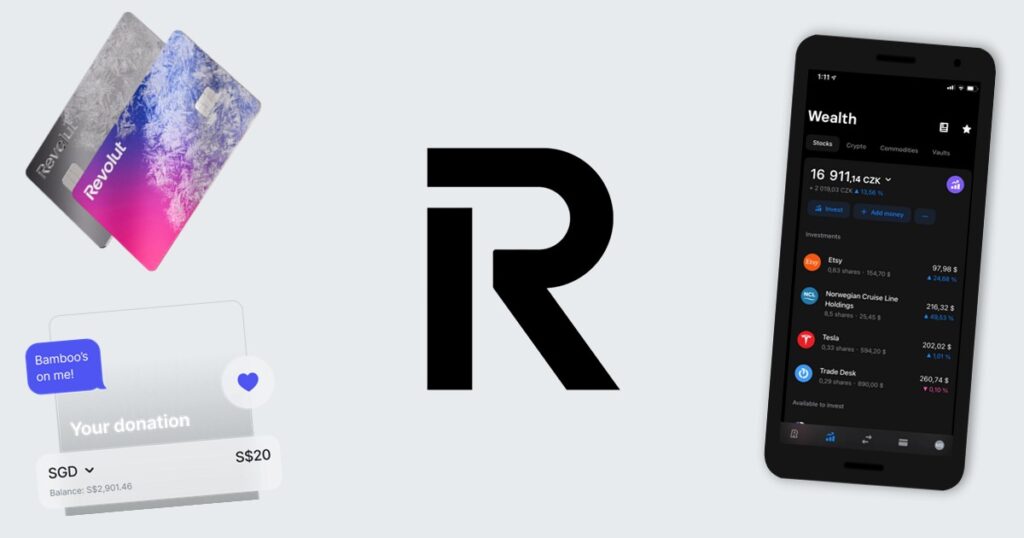

Revolut is no ordinary digital bank. As a trailblazer in the FinTech space, it has reimagined global money management by combining seamless currency exchange with smart, data-driven financial analytics tools. This case study takes a close look at how Revolut is challenging the norms of traditional banking—offering users a frictionless, all-in-one platform to spend, save, invest, and grow their money across borders.

We’ll unpack Revolut’s strategic choices, the technologies powering its platform, and the tangible impact it’s had on users around the world. Along the way, we’ll explore the gaps it fills in the current financial system and what the future holds for this fast-growing FinTech force.

The Revolut Journey: Redefining Money Management

Launched in 2015, Revolut started with a bold yet simple idea: offer fee-free international money transfers. Today, it has grown into a full-scale financial ecosystem serving more than 20 million users across 30+ countries. Headquartered in London, the platform allows users to hold multiple currencies, trade crypto, invest in stocks, and manage budgets—all through a single mobile app.

It’s built for the digital generation—users who expect speed, transparency, and control over their finances without the red tape of legacy banks.

The Challenge: Making Finance Understandable for Everyone

Despite being at the center of global finance for decades, many traditional banks still operate with outdated infrastructure. For individuals and businesses dealing with international payments or managing multi-currency portfolios, the limitations are clear:

- Unclear exchange rates: Most retail banks add hidden markups on foreign transactions.

- Exorbitant fees: International transfers can come with high costs and long processing times.

- Lack of insights: Users get little to no support in tracking spending, setting budgets, or making data-informed financial decisions.

For modern users—particularly frequent travelers, freelancers, and international businesses—these pain points can be both frustrating and expensive.

The Solution: AI at the Core of Financial Intelligence

Revolut took a different approach. By integrating real-time online currency exchange with financial analytics powered by Artificial Intelligence (AI), it created a comprehensive solution that addresses the gaps in traditional banking.

Smarter Currency Exchange—In Real Time

Revolut gives users access to foreign exchange services once reserved for institutions. The platform’s exchange functionality is designed to be fast, transparent, and fair.

- Live interbank rates: No hidden fees or vague conversion margins—users get the real deal.

- Free exchange limits: Monthly fee-free thresholds ensure that everyday users aren’t penalized for managing money internationally.

- Multi-currency wallets: Users can hold, send, and receive over 30 currencies in one place—no need for multiple bank accounts or apps.

It’s the kind of control over money movement that global users have long been waiting for.

AI-Powered Financial Analytics

Revolut doesn’t just show you your balance—it helps you understand your money. Its AI-driven financial analytics features are what make the app a true financial companion.

- Categorized spending breakdowns: Every transaction is automatically grouped (groceries, dining, travel, etc.) for at-a-glance clarity.

- Real-time alerts: If you overspend in a category or approach a budget limit, you’ll know right away.

- Behavior-based insights: Machine learning analyzes your habits to offer tips—like how much you could save monthly or where you might cut back.

It’s not just numbers on a screen—it’s coaching for better financial decisions.

Global Reach with Local Precision

Revolut’s platform is built with inclusivity in mind. Its global footprint includes localized services, multilingual support, and regional financial tools that adapt to different user needs.

- Crypto integration: Users can trade and hold cryptocurrencies like Bitcoin and Ethereum—all from within the same wallet.

- Cross-platform access: Whether on desktop or mobile, the experience is consistent and seamless.

- Offline tools: Budgeting, analytics, and transaction history features work even without an internet connection.

It’s a powerful combination that keeps users connected to their finances—no matter where they are.

Revolut’s Features and Technologies

Revolut’s tech stack is built around a simple idea: make financial management easier, smarter, and more accessible for everyone. From real-time currency exchange to powerful financial analytics, Revolut has crafted a robust suite of features that serve individuals, businesses, and families alike.

The Revolut App: Your Gateway to Digital Banking

At the heart of it all is the Revolut app—a sleek, user-friendly platform packed with functionality. Whether you’re managing day-to-day expenses or tracking long-term financial goals, the app puts everything you need right at your fingertips. It’s available on both iOS and Android, with millions of downloads and consistently high user ratings to back it up.

Designed for Different Needs

| App Type | Target Users | Key Features |

|---|---|---|

| Personal Finance | Individuals, millennials, digital banking newcomers | – Real-time spending tracking – Budget creation and expense categorization – Currency exchange and international transfers – Crypto wallet integration |

| Business | SMEs, freelancers, large organizations | – Multi-user access – Payroll and expense management – Advanced cash flow analytics – Streamlined financial operations |

| Junior | Children and families | – Parent-controlled fund transfers – Spending limits and real-time monitoring – Teaches basic money management and financial responsibility |

Why Users Love the Revolut App

Revolut’s app stands out for its ease of use, smart design, and global accessibility. It lets users manage their money from anywhere, syncs seamlessly across devices, and even works offline for key features like budgeting and transaction history.

Here’s what users consistently highlight:

- Simplicity and Speed: The app is intuitive and quick to navigate, even for first-time digital banking users.

- Transparency and Trust: Real-time alerts and upfront fee disclosures help users feel in control.

- All-in-One Flexibility: Whether it’s managing budgets, trading crypto, or exchanging currencies, it all happens in one place.

- Consistent Reliability: Despite occasional customer support delays during peak times, user satisfaction remains high, reflected in its 4.5-star average rating.

Revolut Card Reader: Merging the Physical with the Digital

For small businesses and freelancers, Revolut’s card reader offers a practical way to accept payments without the complexity of traditional POS systems. It’s compact, simple to set up, and integrates directly with the Revolut Business app.

Why businesses love it:

- Plug-and-play simplicity: Accept payments fast, no technical know-how needed.

- Supports all payment types: From chip-and-PIN to contactless payments and mobile wallets like Google Pay and Apple Pay.

- Transparent fees: No hidden costs, just competitive pricing.

- Instant updates: Every transaction is reflected in real time, making cash flow management easier.

By offering a physical solution that ties directly into its digital ecosystem, Revolut gives businesses the tools they need to operate more efficiently.

Virtual Cards: Smarter Spending, Built-In Security

Revolut’s virtual cards offer a flexible, secure way to manage online payments. Whether you’re a solo user or running a business, these cards provide peace of mind and precise control.

- Instant issuance: Generate a new card with just a few taps, ready to use immediately.

- Disposable options: Use once and it disappears—perfect for one-off purchases and added security.

- Multi-currency ready: Use your virtual cards across different currencies without extra fees.

- Track every penny: Assign cards to specific subscriptions or purchases to keep budgets in check.

As online transactions continue to rise, Revolut’s virtual cards are helping users stay safe, organized, and in control.

Marketing and SEO Strategy

Revolut’s marketing success is driven by a multifaceted strategy:

- SEO Optimization: Ranks highly for keywords related to digital banking and financial analytics.

- Content Marketing: Produces informative content to educate users on financial topics.

- Referral Programs: Encourages user growth through incentivized referrals.

- Social Media Engagement: Active presence on platforms to interact with users and promote features.

These efforts have significantly enhanced Revolut’s online visibility and user acquisition.

Outcomes and Results

Revolut’s approach to online currency exchange and financial analytics hasn’t just modernized banking—it’s transformed how millions of people manage their money. Its impact is measurable, far-reaching, and steadily reshaping the financial services landscape.

Revolut’s performance over the past four years has been nothing short of remarkable. From 2021 to 2024, revenue grew over fivefold—from £0.6 billion to £3.1 billion. Net profit jumped significantly in 2023 and nearly doubled again in 2024, reaching £790 million. User growth has been steady and strong, climbing from 16.4 million in 2021 to 52.5 million in 2024. Likewise, monthly transactions surged from 199 million to 940 million in the same period, reflecting both rising user activity and platform engagement.

This surge reflects more than just user adoption—it shows how Revolut’s multi-currency wallets, crypto tools, and AI-driven financial analytics are hitting the mark in a crowded market.

Breaking Down the Revenue (2023)

Revolut’s revenue streams are as diverse as its user base. Here’s how the numbers stack up:

Revolut’s revenue in 2024 demonstrates a well-diversified business model. Interest income led the way, contributing £790 million, followed by card payments (£694 million) and wealth services including crypto (£506 million). Subscriptions and FX-related services also played a significant role, each bringing in over £400 million. This mix of transactional, subscription, and investment-based revenue streams positions Revolut for stable, scalable growth.

By balancing core banking services with newer products, Revolut spreads risk while building long-term growth across sectors.

Growth and Adoption

The numbers speak for themselves:

- As of the end of 2024, Revolut boasts over 52.5 million users worldwide, marking a substantial increase from previous years.

- The Revolut app has been downloaded over 50 million times across iOS and Android platforms, reflecting its widespread adoption.

- Revolut maintains one of the highest user retention rates in the digital banking sector, with reports indicating a retention rate of approximately 98%, showcasing strong user engagement and satisfaction.

This level of adoption places Revolut among the most downloaded and widely used FinTech apps on the market.

Real Financial Impact

Revolut isn’t just gaining users—it’s helping them save money and make smarter decisions:

- Customers report saving hundreds of pounds annually through transparent exchange rates and lower international fees

- Businesses use Revolut to simplify payroll, manage cross-border payments, and get clearer insights into cash flow

- The platform’s tools are helping users take real control over their financial lives

Boosting Financial Literacy

Revolut’s analytics aren’t just informative—they’re educational. The app’s budgeting tools and spending insights are making a lasting difference in how users manage their money:

- 75% of active users regularly engage with budgeting features

- 60% see improved financial habits within six months of use

That’s not just a feature—it’s financial empowerment.

Global Expansion and Partnerships

Revolut isn’t just growing its user base—it’s expanding its global presence through smart partnerships:

- Active in Europe, Asia, and the Americas, with localized features for each market

- Partnerships with top travel and e-commerce platforms offer exclusive perks and fee-free services

- These collaborations boost both visibility and value for users

Raising the Bar for FinTech

Revolut hasn’t just joined the FinTech race—it’s helped rewrite the rules. Its success has pushed competitors to up their game and inspired a wave of innovation focused on user experience, transparency, and real-time digital finance.

By proving what’s possible with smart, integrated banking tools, Revolut is leading a global shift toward a more transparent, user-first future in finance.

Competitive Landscape

In the fintech arena, Revolut faces competition from several key players:

| Feature | Revolut | Monzo | N26 | Wise |

|---|---|---|---|---|

| Multi-Currency Accounts | ✅ | ❌ | ✅ | ✅ |

| Cryptocurrency Trading | ✅ | ❌ | ❌ | ❌ |

| Stock Trading | ✅ | ❌ | ❌ | ❌ |

| AI-Driven Analytics | ✅ | ✅ | ✅ | ❌ |

| Business Account Support | ✅ | ✅ | ✅ | ✅ |

Revolut’s comprehensive feature set and emphasis on AI-driven financial analytics provide a competitive edge in the digital banking sector.

Challenges and Limitations

Despite its successes, Revolut faces certain challenges:

- Regulatory Compliance: Navigating complex financial regulations across different countries.

- Market Competition: Staying ahead in a rapidly evolving fintech landscape.

- User Trust: Maintaining user trust amidst concerns over data privacy and security.

- Service Limitations: Addressing user feedback regarding customer support and feature availability.

Addressing these challenges is crucial for sustained growth and user satisfaction.

Final Thoughts: A Blueprint for the Future of Digital Banking

Revolut isn’t just keeping pace with the digital finance revolution—it’s setting the standard. By combining real-time currency exchange, AI-powered financial analytics, and a user-first mobile experience, the company has reimagined what modern banking can look like.

From individuals managing day-to-day budgets to businesses navigating global markets, Revolut delivers a powerful, flexible platform that adapts to users’ needs. Its consistent innovation, expanding global reach, and focus on financial empowerment have positioned it as a true leader in the FinTech space.

As Revolut continues to grow, its core promise remains the same: make managing money faster, smarter, and more accessible for everyone.

Key Takeaways

- Customer-Centric Innovation: Revolut’s success is rooted in addressing real-world pain points with smart, user-friendly solutions.

- AI-Driven Insights: With built-in financial analytics, users gain actionable insights into spending, saving, and financial health.

- Borderless Banking: Multi-currency wallets and transparent exchange rates make global finance simpler and more affordable.

- Scalable Ecosystem: From individuals to enterprises, Revolut’s flexible tools serve a wide range of users and use cases.

- Sustainable Growth: Strong revenue diversification and global expansion have made Revolut one of the most resilient names in FinTech.